This blog post is an overview of the steps required to set up a Bitcoin business in Canada. It was written by Addison Cameron-Huff, a lawyer who specializes in Bitcoin. He highly recommends that you obtain your own legal advice before starting a Bitcoin-related company.

Every business is different but the following steps are an overview of the general process that many businesses take in order to get started.

Step 1: Identify Legal Issues with Your Proposed Business

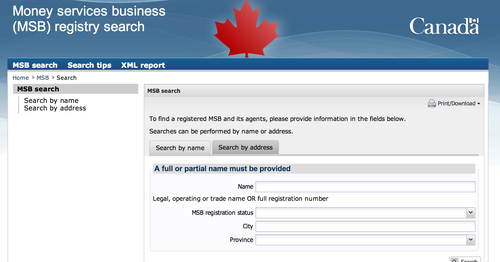

There may be laws that restrict your ability to do business or might direct you to carry out your business in a certain way. The Bitcoin space is filled with misunderstandings about the law and some businesses may be subject to complex regulatory schemes (e.g. anti-money-laundering rules).

Step 2: Sole Proprietorship vs. Partnership vs. Corporation

The first step is to consider the business organization that you’d like to set up. This can be deceptively complex and hiring a lawyer may be quite helpful.

The provincial organization that regulates lawyers (Law Society of Upper Canada) provides this document with issues for lawyers to consider: http://www.lsuc.on.ca/For-Lawyers/Manage-Your-Practice/Practice-Area/Business-Law/How-to-Choose-the-Right-Business-Vehicle/.

The simplest form is the sole proprietorship where you do business in your own name. A partnership is a business that’s similar to a sole proprietorship but with several individuals who jointly own the business. A corporation is a business that has an existence separate from that of the people running it.

Most startups choose to create a corporation for a variety of reasons (many entrepreneurs cite “limited liability” as their motivation). Often if incorporation isn’t chosen it’s because the sole proprietorship/partnership results in a more favourable tax scenario. An accountant or lawyer can help you understand the best structure for your circumstances.

Step 3: Federal vs. Provincial Incorporation

Corporations may be created at either the federal or provincial level. While there is often no practical difference between federal and provincial corporation there may be reasons to select one or the other for your circumstances. A federal incorporation is $50 cheaper.

Step 4: Business Name

Do you want to create a named company or a numbered company? A named company would be something like “ABC Inc.” A numbered company is one that looks like “12345678 Canada Limited”. Numbered corporations are issued faster and may better reflect how you wish to interact with business partners, government, banks, etc.

If you opt for a numbered corporation then you will have to register any other names that you’d like to do business under (e.g. “12345678 Canada Limited” doing business as “Ottawa Bitcoin Consultants”). Business name registration in Ontario can be done online using the Integrated Business Services Application.

Step 5: Registration Steps

If you are registering a federal corporation then you should consult the Guide to Federal Incorporation before beginning the registration process.

Online incorporations are done through Industry Canada’s Online Filing Centre: https://www.ic.gc.ca/app/scr/cc/CorporationsCanada/bs/crp-wz.html.

Step 6: Meeting of Initial Directors and Shareholder Meetings

Once a company is created, the initial directors will have a meeting to decide on how the company should be run. The long-term directors will be appointed and shares granted.

Following the initial directors meeting there will be a meeting of the shareholders.

Step 7: Banking, Accounting, Legal, Compliance, etc.

Depending on your business there may be a host of issues that you should consider once you have created your company including: setting up a bank account, registering for HST, considering how people who work for you will be paid, WSIB registration, corporate tax returns, corporate record keeping, bookkeeping, anti-money-laundering compliance, leasing space, drafting contracts with customers, domain registration, etc.

Decentral Toronto at 64 Spadina Ave. operates a co-working space and rents private offices.

Made in Canada

Made in Canada