This blog post is about how the ideas of Bitcoin could be applied to Ontario’s land ownership records system (POLARIS). It was written by Addison Cameron-Huff, a lawyer retained by Decentral in Toronto.

Photo from http://www.flickr.com/photos/wwworks/2959833537/

“Smart property” is a concept of great interest in the cryptocurrency industry. Smart property is property for which:

- the ownership can be verified through a decentralized trust system (like the Bitcoin protocol); and,

- transfers can take place using the electronic system.

Could Ontario adopt a smart property system for land records?

Knowledge of how Bitcoin works is a prerequisite to thinking about how a property system based on it could function.

Explaining Bitcoin: Provable Transactions + Ownership

The Bitcoin protocol allows anyone to verify the transactions that have taken place within the system (the “blockchain”). This is possible because Bitcoin creates a snapshot every ten minutes of the last ten minutes of activity and adds that to the list of transactions that have happened since the start of Bitcoin (this is called “mining”). The records can’t be changed after the fact due to the use of hashing functions.

Bitcoin allows the holder of bitcoins to prove that they are the owner because they are the only person with the password (see this explanation of public key cryptography for details). The person with the password can “sign” a transaction with their password to prove that they are the owner.

If anyone can prove that they are the holder of a certain item and everyone else can see the history of transactions that led to them being the holder, then you have the basis of a system of provable ownership and secure transfer.

Real Estate Smart Property: POLARIS

How could smart property concepts be applied to real estate?

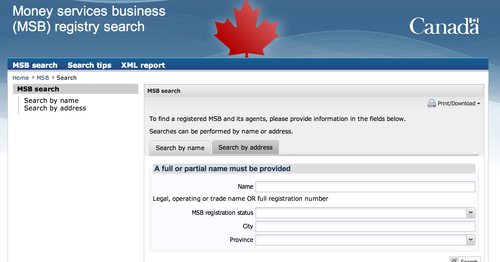

At the heart of smart property is the idea of electronic records that prove ownership. For most kinds of property there is no official record of ownership that can be consulted – it’s generally up to the buyer to ascertain who the owner of something is. One notable exception is POLARIS: the database of ownership of real property in Ontario.

POLARIS is a part of the Land Titles System, the legal regime for property ownership that covers most land in Ontario. It is is the central repository for all records of who owns what real estate. You can read more about it here: http://www.teranet.ca/node/131.

POLARIS and smart property are complicated concepts so the following discussion can only touch on a few points of comparison but will hopefully illustrate the contrast between the two systems. This blog post considers a block chain-based smart property system.

POLARIS: Disadvantages

POLARIS has a few disadvantages:

1. it is centralized and access is provided only through a private company called Teranet (they bought the right to run the system until 2067 for $1 billion + royalties and are owned by Borealis, the investment arm of OMERS); and,

2. it’s very difficult to prove that the person transferring land is the possessor of that land (the problem is currently handled by only lawyers doing transfers); and,

3. it’s expensive to look up ownership of property (about $30 per search + $600 to register); and,

4. it’s not possible to build new applications that use property records.

Smart Property System: Benefits

A smart property system for land ownership could improve upon POLARIS in a few ways:

1. anyone could inspect any property record in real-time (because everyone has an up-to-date version of all of the records); and,

2. access to records would cost almost nothing (<1 cent); and,

3. authenticating the holders of property would be easy (because the holder is the one with the password) so owners could transfer land without using lawyers; and,

4. transactions fees could be very low; and,

5. anyone could build applications on top of the property system to provide new ways of accessing records (e.g. an automated mortgage fraud detection system).

Despite the upsides of a smart property system, changing the real estate database system would pose a number of significant challenges.

Smart Property Real Estate System: Challenges

POLARIS has been in place since the 1980s. It may not be ideal but a new system is likely to introduce “bugs” that would have enormous costs for some people (e.g. a bank might foreclose on the wrong person).

There would also be problems that are specific to switching to smart property:

1. passwords would have to be distributed to the current owners of land; and,

2. if a user loses their password they’d lose ownership of the land (and if they didn’t, the ownership database would be out-of-sync, defeating the purpose of having the system); and,

3. theft of real estate passwords would become a massive fraud issue (although real estate fraud is currently a major problem for banks, consumers and insurers).

Any sane system that follows smart property principles would have to figure out a method of “recovering” ownership when the password is lost. (This problem could be mitigated by implementing “multisignature transactions”).

Although there would be advantages to a smart property system, many of them would be hard to quantify, such as the benefit from new applications that are impossible to create under the current system. In 1980 no one could have calculated the value of the Internet (and what is Wikipedia worth?). Furthermore, many people misplace their car keys – they’re not going to be able to keep track of the password for their home ownership record.

In addition to the practical issues of switching to smart property the province would be forced to pay billions to Teranet (the operator of POLARIS) if it cancelled its 57 year monopoly agreement.

Conclusion: Looking Forward

2014 isn’t going to be the year of smart property real estate records. That said, it will be a year where these ideas move closer to application, and the power of decentralized crypto trust systems gains wider recognition. By 2067 we’ll probably have something better than POLARIS.

Discussion

Smart property and real estate are big, challenging topics. Please do contact the author (addison@bitcoindecentral.ca) if you think a mistake has crept in or there’s an aspect you’d like to see explored in a follow-up blog post.

Made in Canada

Made in Canada