This blog post was written by Addison Cameron-Huff, a lawyer who specializes in Bitcoin. He highly recommends that you obtain legal advice before acting in the Bitcoin space.

Photo from http://www.flickr.com/photos/dennis/12212589286/

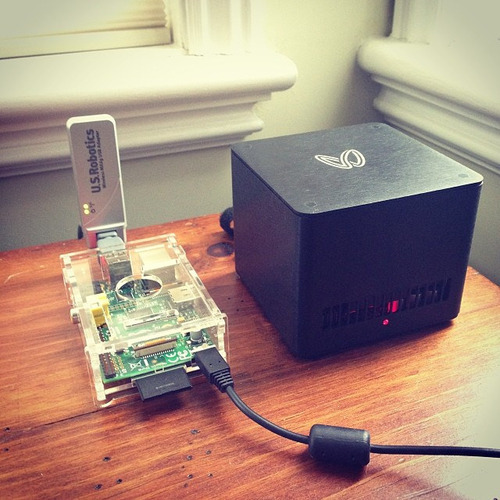

Bitcoin mining is the process by which new bitcoins are generated. It requires buying hardware (“ASIC miners”) to mine bitcoins and power to run the hardware.

If you’re mining to make a profit then you may be able to deduct your business-related expenses.

According to the CRA: “As a rule, you can deduct any reasonable current expense you paid or will have to pay to earn business income.” There are many exceptions to this “rule” and a tax advisor should be able to help you determine whether you are operating a business for which you can deduct mining expenses.

Made in Canada

Made in Canada