This blog post was written by Addison Cameron-Huff, a lawyer who works for Bitcoin Decentral. The definitions below have been simplified to make Bitcoin approachable. To learn more about what these words mean you should attend the Bitcoin Decentral Toronto Meetup at 64 Spadina Ave., Toronto every Wednesday night at 7pm.

Photo from https://www.flickr.com/photos/andrewrennie/5239376110

Address = A public identifier to which bitcoins can be sent, similar to an email address. An address always has a corresponding “private key” that can be used to transfer the bitcoins that reside at that address. An address looks like this: 1M72Sfpbz1BPpXFHz9m3CdqATR44Jvaydd.

Bitcoin = The protocol that computers use in order to send or receive bitcoins (capital B = the protocol, lowercase b = the currency). Think of the Bitcoin protocol like the system by which banks process cheques – the cheque system (Bitcoin protocol) is how money (bitcoins) is moved between accounts. “BTC” is the abbreviation in the same way that “USD” is the abbreviation for US dollars.

Block = A snapshot of the transactions that occurred over a period of time, usually several minutes.

Block Chain = The decentralized database of every Bitcoin transaction that’s ever happened. Other cryptocurrencies have their own block chains.

BTM = A Bitcoin ATM machine, like this one at Decentral Cowork in Toronto.

Cryptocurrency = A system for transferring units of wealth between users that makes heavy use of cryptography principles.

Exchange = A business that allows its customers to buy and sell bitcoins with each other (note that an exchange doesn’t sell its own bitcoins). Think of exchanges like stock exchanges. Examples of Canadian exchanges are Vault of Satoshi and VirtEx.

Mining = The process by which new bitcoins (or other cryptocurrencies) are created. Bitcoin Mining creates new “blocks” in the “block chain”.

Private Key = The password that allows someone to transfer bitcoins.

QR Code = Bitcoin “addresses” are often displayed as black and white checkerboard patterns that can be easily scanned using phone cameras. An example QR code can be seen in the top right of this page: http://seansoutpost.com/donate/.

Wallet = A computer program for holding passwords (“private keys”) and “addresses”. Blockchain.info (online and mobile), Electrum (desktop program), KryptoKit (Chrome extension) and Armory (desktop program) are popular wallets.

Advanced Definitions

Altcoin = Alternative Coin = A digital currency based on (usually competing with) Bitcoin.

ASIC = Application Specific Integrated Circuit = Specialized hardware that has been designed to mine Bitcoins.

Dealer = Someone who buys or sells bitcoins. A good online example of this is QuickBT. Localbitcoins.com (a bit like Craigslist) is the most popular website for dealers to connect.

Digital Currency = See “Virtual Currency” below.

Dogecoin = An altcoin created as a joke but that has gone on to become popular enough to be used to sponsor an Olympic team and a NASCAR car.

Hash = A type of mathematical function that is a building block of the cryptography that Bitcoin uses. All of the computers that together form the Bitcoin network collectively do approximately 75,000,000,000,000,000 hashes per second.

Litecoin = The second most popular altcoin. The key innovation is that “mining" Litecoin requires processing power + memory (instead of just processing power).

Mixing Service = A software service that mixes transactions together in order to create a confusing or impossible to follow trail. An example of a mixing service is coinjoin.

Paper Wallet = A piece of paper with a private key and address.

Signing = The process by which a private key is used to create a Bitcoin transaction. For more information on how Bitcoin transactions work: http://www.coindesk.com/information/how-do-bitcoin-transactions-work/.

Virtual Currency = A synonym for "digital currency”, a non-traditional online currency. Bitcoin and Linden Dollars are virtual currencies.

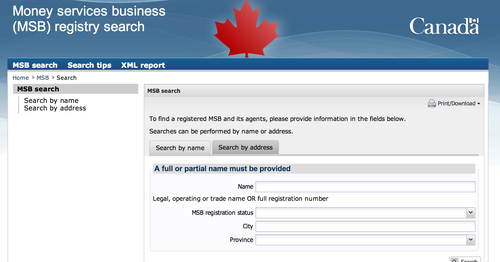

Made in Canada

Made in Canada