A recent study out of the University of Colorado Boulder outlines the ways in which money transfers from migrant workers to families in developing countries help reduce poverty and improve their standard of living. The study was conducted in partnership with money transfer service company Western Union, and it touts the benefits that transferring money via Western Union brings to low-income communities around the world. Here are some of the highlights:

Communities that are recipients of remittances benefit from the influx of foreign currency, both directly and indirectly.

a) Recipients will often reduce their work hours or drop out of the workforce altogether, usually in order to get an education or care for young children or aging relatives.

b) Older recipients are able to retire and enjoy a better quality of life.

c) This diminished local workforce often results in higher wages for other members of the community.

d) Spending on local goods and services, as well as personal savings, increases, indirectly benefiting the rest of the community by creating better employment opportunities and supporting higher wages.

Remittance flows have become the second largest, and most stable, source of foreign currency and development assistance worldwide.

Official development assistance used to be the largest contributor but, in the past 25 years, it has been outpaced dramatically by foreign direct investment (FDI) and remittances. FDI can be extremely volatile and unstable, depending on global financial markets, but remittances have seen steady and stable growth.

- Most remittances flow to middle income countries (71%) with just 6% flowing to low-income countries

- Remittances to low income countries, however, now represent 8% of the GDP (up from 2% in 2008), compared to 2% of GDP for middle-income countries. Thus, the impact of remittances is felt more acutely in low-income countries.

The general trend worldwide is toward lower official transmission rates, according to a World Bank report in September of 2014.

The global average transmission rate fell below 8% for the first time in Q4 2014, to 7.9%, down from 8.93% in Q3 2013. The average remittance cost declined most sharply for East Asia.

The Philippines as a case study

According to the study, every ₱100 spent by households generates ₱223 of additional output. On average, each Western Union affiliate office transmits ₱23.2 million in remittances ($552,941 USD), enough to support an additional 85 full-time jobs, usually in the area where the WU office is located. (272,949 = 1 f/t worker)

Overall, remittances through WU offices in the Philippines are then calculated in the study as:

- 25% of all remittances for the country

- generating approximately 720,825 full-time jobs

Apart from banks and Western Union, informal remittances contribute another 30-40% of foreign currency that flows into the Philippines.

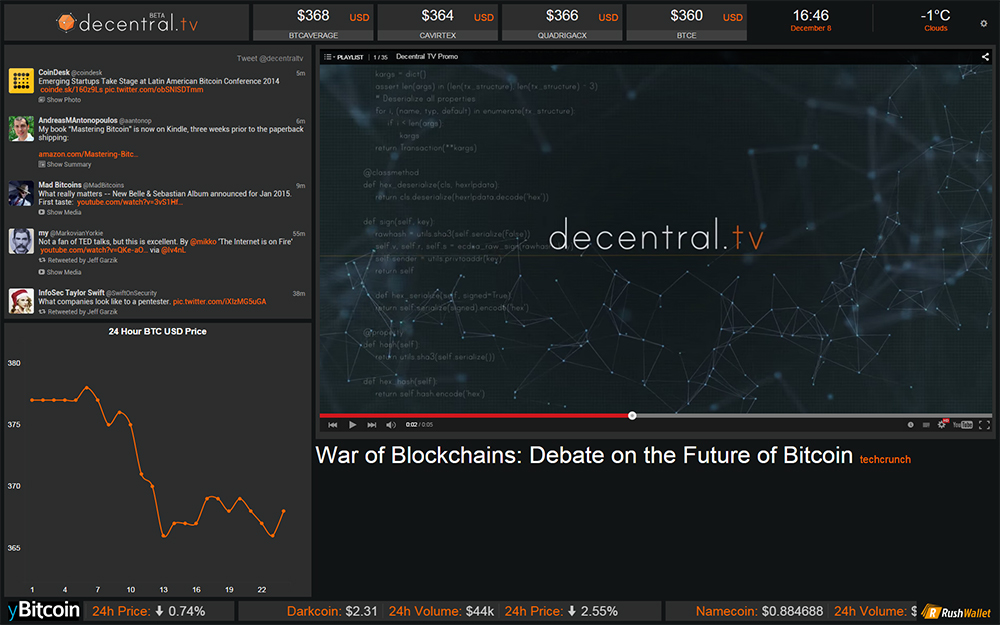

A Bitcoin Perspective

The most interesting thing about this report, from a bitcoin perspective, is the overall conclusion that remittances offer a net gain for recipient communities. There are some potential drawbacks, but the study concludes that the positives outweigh the negatives.

Imagine if even one half of those Western Union remittances had been sent using bitcoin.

In the Philippines, sites like coins.ph and rebit.ph make it safe and simple for Filipino recipients to receive and convert bitcoins into pesos. According to the Rebit website, they charge no fees on their transaction.

Fees may be charged to exchange your BTC for pesos, depending on how you choose to receive your money:

“These fees are paid directly to the provider you select. For example, Cebuana Lhuillier cash pickup will charge an additional PhP240 for a PhP10,000 transfer. Meanwhile, a bank account deposit within Metro Manila is free. As you fill in the rebittance form, the pricing display on the sidebar changes to show you what the total cost of the transfer will be.” – rebit.ph

Using this model, let’s see what would happen if even half of those Western Union transfers had been made in bitcoin:

According to the study out of University of Colorado Boulder, each Western Union office, on average, handles ₱23.2 million in remittances. Half of those remittances equals ₱11.6 million. Transferring that ₱11.6 million in bitcoin would have saved ₱812,000 (@7%) in fees. (I based this percentage on the average quoted in the study.)

According to the study’s calculations, ₱272, 949 in remittances = 1 full-time job created. That means approximately two more full-time workers could have been hired (1.97) at each Western Union location if just half of those transaction had been made in bitcoin. Nationally, that works out to about 167,450 additional jobs!

I also spoke with Philip Agyei Asare, a Bitcoin advocate in Ghana, and asked him if it was just as easy for average Ghanaians to buy, transfer, and sell bitcoins as it is for them to use Western Union and other traditional remittance agencies. He assured me it was; in fact, many Africans also use bitcoin to shop online.

“[People] just need to be educated on how to use the platform [and then be able to educate] the people in diaspora because they will be sending in money to their family and loved ones in Africa,” he said.

Asare is doing his part to help educate: He has been invited to speak on the topic of “Bitcoin in Africa” at the [Bitcoin Consumer Fair in Atlanta] (http://bitcoinconsumerfair.com/) this April. (If you would like to support his efforts to attend, you are welcome to send tips/donations to his address: 1BNht8bCmbZVkmR2FJQaWh7Gmcr2qLZCod).

Some final thoughts…

There are two lines in the report that stood out for me:

- “The Central Bank and other bankers dislike any proliferation of informal remittance agents who transfer funds through informal channels for lower fees than formal banks and transmission services can charge. However informal transmissions may begin to slow as the cost of formal remittance cost declines.” Perhaps what we can take away from this statement is as follows: Banks and other formal remittance services are having to play catch-up when it comes to charging less for remittances now that other informal channels – like bitcoin – are offering cheaper and faster alternatives.

- “As the [cost percentage] rate of formal services declines, senders will increasingly utilize formal mechanisms, due to higher convenience and security, compared to informal channels.” Unless the informal channel you are using is Bitcoin, of course, with its highly secure protocol. The flipside to this statement in the study is that people are looking for low-cost, secure ways to send and receive money. Here is where bitcoin is able to make inroads.

As for expecting people to return to using traditional transmission services just because their fees go down a bit, that might be wishful thinking on the part of the Central Bank and Western Union, especially if they could understand just what sort of impact the savings could have on the local economy.

Disclaimer/note: Referencing coins.ph and rebit.ph does not mean that I endorse either website, or that one company is any better than the other. I chose to use rebit.ph in my example simply because I found the website a bit easier to navigate and the answers to my questions were clear.

Made in Canada

Made in Canada